How Japanese credit cards work

You probably have had experience wondering how you can pay the bills to the credit card company, how the billing cycles and credit limit for your Japanese credit card work, etc.. Here is some information that may help you clear up the ambiguity you may have about credit cards in Japan.

Page contents

How the credit card bills are paid

Most Japanese credit card companies require applicants for credit cards to link their bank accounts to their credit cards when they file the application. Monthly bills are automatically deducted from the designated bank accounts that are linked to the credit cards. Therefore, you don't have to worry about when you have to run to the bank ATM to deposit the money to pay the credit card bills, etc..

Billing cycles

Your credit card transactions are billed to you in periods of time known as "billing cycles", each of which is a one-month period. The last day of the billing cycle is your account statement closing date, on which the transactions you have made over the billing cycle are to be compiled together to be billed to you in the following month.

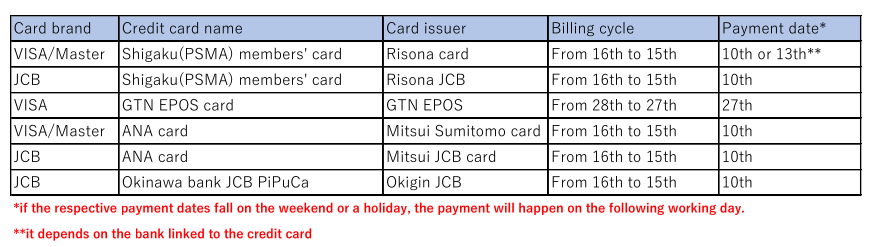

Billing cycles for Japanese credit cards vary depending on the credit card companies. A billing cycle doesn't necessarily start at the beginning of the month and end at the end of the month. Some credit card companies have billing cycles that start on the 16th of the month and end on the 15th of the next month. Let's have a look at the list of billing cycles for the credit cards many OISTers have applied for.

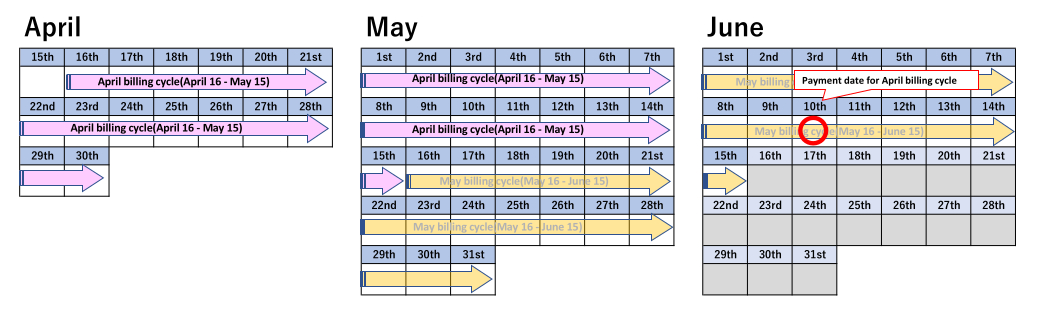

As you can see on the table above, many of the credit card companies OISTers have applied for have billing cycles that are between the 16th of the month and the 15th of the next month. Below is an example of how the billing cycle and payment date work if the billing cycle is between the 16th and the 15th, and the payment date is the 10th of the month.

The bill for the transactions made between April 16th and May 15th is to be deducted from the designated bank account on June 10th. Therefore, there is a gap of nearly two months between the first transactions in the billing cycle and the payment date of the billing cycle.

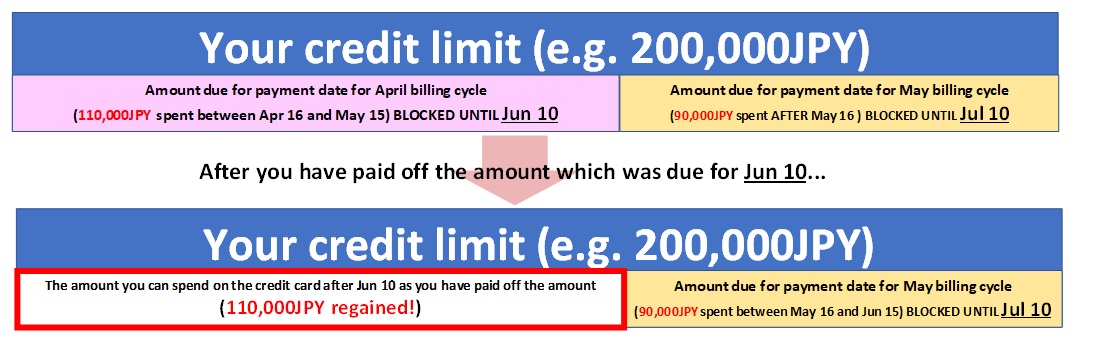

Credit limit

Credit limit refers to the maximum amount of money a credit company will allow its customers to spend using their credit cards. The credit card company sets the credit limit based on the information submitted on the application form for the credit card. The amount you can spend on your credit card decreases as you spend money using your credit card and you cannot use your credit card beyond your credit limit. You regain the decreased amount once you have paid off the amount on the payment date. Note that you don't necessarily regain the full credit limit on a payment date as some amount might be due for the next billing cycle's payment date(it depends on when you used the card, what your card's billing cycle is, etc.)

If you want to increase your credit limit or regain the decreased amount immediately(e.g., you want to regain the 90,000JPY portion in the above picture before Jul 10 to regain your full credit limit), you can do so by following the below procedures;

- Increase the credit limit: Call the credit card company to ask for a credit limit increase. However, it's not guaranteed that your request for this will be granted.

- Regain the decreased amount: You can regain the decreased amount by paying off the amount before the next payment date. Call the credit card company and tell them that you want to pay off the amount that is due for the next payment date, get their bank account info, transfer the amount using an ATM. If you succeed in paying the amount by a particular time of the day, you may be able to regain the amount on the very same day, otherwise, the amount will be regained on the next working day.