JCI inspection - Shaken(車検)

Contents of the page (click to jump to the content you are looking for)

- What is a Japanese Compulsory Insurance inspection?

- How to check when the car is due for the inspection

- Required documents and items

- Breakdown of Shaken costs

- The areas to be checked during the Shaken inspection

- English-speaking and nearby garages

- FAQs

What is a Japanese Compulsory Insurance inspection(Shaken)?

Although the term "Japanese Compulsory Insurance Inspection" may sound a bit confusing, it is a car inspection that consists of several procedures to complete the whole inspection;

- Compulsory biennial vehicle inspection

- Compulsory vehicle liability insurance purchase (which is good for 2 years)

- Biennial weight tax payment

A vehicle inspection (shaken or JCI inspection) is a compulsory inspection for all vehicles on the road in Japan that must be conducted every 2 years. It ensures that all vehicles on the road are properly maintained and safe to drive. The inspection also checks that vehicles have not been illegally modified. Along with the inspection, payments for Japanese Compulsory Insurance (JCI, or compulsory vehicle liability insurance) and weight tax for the upcoming 2 years must be made. It's illegal to drive vehicles in Japan without having this inspection complex carried out.

The inspection must be carried out at an authorized service garage or at the inspection centre located in Urasoe city. Inspection and maintenance services can also be found at most car dealers.

If you are asking a service garage or a car dealer to carry out the inspection on your behalf, the service garage or the dealer will normally provide you with an estimate, including the maintenance fees and agent fee, etc., before they proceed with the inspection.

If you are carrying out the inspection by yourself at the inspection centre, you will need to make sure the vehicle is in a condition to pass the inspection and buy compulsory vehicle liability insurance from an insurance company before visiting the inspection centre. It may be a good idea to have the vehicle thoroughly checked by a mechanic for a small fee before going to the inspection centre to make sure the vehicle is likely to pass the inspection. Otherwise, you will end up going back and forth to the inspection centre in case the vehicle is not in the condition to pass the inspection.

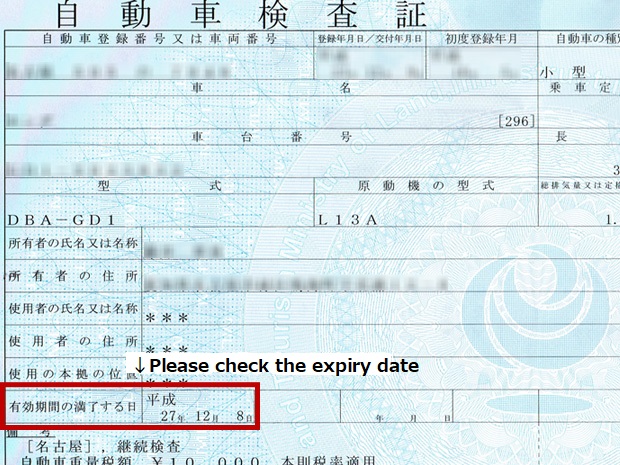

How to check when the car is due for the inspection

The inspection expires every 2 years. To check when your car is due for the next inspection, please check the expiry date of the current inspection on the JCI inspection certificate.

The expiry date is in this format: year(in the Japanese Calendar)/month/day

| Western Calendar Years | Japanese Calendar Years |

| 2028 | 令和10年 |

| 2027 | 令和9年 |

| 2026 | 令和8年 |

| 2025 | 令和7年 |

| 2024 | 令和6年 |

| 2023 | 令和5年 |

| 2022 | 令和4年(or 平成34年) |

| 2021 | 令和3年(or 平成33年) |

| 2020 | 令和2年(or 平成32年) |

| 2019 | 令和元年(or 平成31年) |

| 2018 | 平成30年 |

Also, you can check the expiration date on the sticker on your windshield.

This shaken expires on September 2022

Required Documents and Items:

This document should be kept in the vehicle and contains information about the vehicle and its registered owner, as well as the date when the current shaken/JCI expires.

- Road tax payment receipt (自動車税納税証明書):

Road tax is the tax to be paid by the owner of the vehicle every year. If you are the owner of the vehicle as of the 1st of April of the year, you are subject to the tax. This tax is levied by the municipality if you own a Kei-car and by the prefectural government if you own a white-plate car. Make sure to keep all the receipts for the road tax payments.

If you are carrying out the inspection by yourself at the inspection centre, make sure to buy new vehicle liability insurance at one of the insurance companies for the upcoming 2 years before visiting the inspection centre, and bring the new insurance certificate along with the expiring insurance certificate to the inspection centre. This vehicle liability insurance can be purchased at one of the insurance companies' offices located across the road from the inspection centre.

Breakdown of Shaken costs

The costs for the inspection can be classified into two categories below:

- The basic charge for the inspection:

This is basically the cost to be paid to the third party to carry out the inspection(if you are using any) beforehand to make sure the vehicle is in the condition to pass the inspection at the inspection centre.

- Law-regulated expenses:

These expenses are the expenses to be paid at the inspection centre. The expenses include biennial weight tax payment, and compulsory vehicle liability insurance, etc.

If you are using a third party, such as a service garage, to carry out the inspection on your behalf, both of the above costs have to be paid through a service garage.

If you are carrying out the inspection by yourself at the inspection centre, you only need to pay the law-regulated expenses when carrying out the inspection at the inspection centre.

Breakdown of the inspection costs:

Please be noted that this information was made based on the information as of January 2021.

The prices shown below are a rough estimate. Some prices may vary depending on the service you are using.

| Basic charges for Shaken/JCI inspection (prices vary from garage to garage) | |

| Law-regulated 24th-month inspection fee | Approx. 20,000JPY |

| Safety standards conformity inspection fee | Approx. 10,000JPY |

| Agent fee | Approx. 10,000JPY |

*Maintenance fees and other costs may be required on top of the above costs if the vehicle is not in a condition to pass the inspection.

| Law-regulated expenses (fixed) for cars younger than 13 years old | ||||

| Item | Kei-cars | Cars weighing 1 ton or less | Cars weighing more than 1 ton | Cars weighing more than 1.5 tons |

| Automobile weight tax | 6,600 | 16,400 | 24,600 | 32,800 |

| Compulsory vehicle liability insurance | 11,200 | |||

| Revenue stamp fee | 1,100* | 1,200** | 1,200*** | 1,200*** |

*1,400 if carrying out the inspection by yourself at the inspection centre

**1,700 if carrying out the inspection by yourself at the inspection centre

***1,800 if carrying out the inspection by yourself at the inspection centre

The areas to be checked during the Shaken inspection:

- Exterior

The vehicle must meet Japanese exterior regulations and not have illegal exterior modifications, such as extreme body kits that increase the exterior dimensions.

- Wheel Alignment

The vehicle’s wheels must be in-line and able to turn correctly

- Speedometer Inspection

The vehicle’s speedometer must be accurate

- Headlamp Inspection

The vehicle’s headlights must be correctly placed and aligned

- Brake Inspection

The vehicle’s brakes must work correctly

- Exhaust Gas/Muffler Inspection

Tests carbon monoxide and hydrocarbon emissions along with exhaust noise level

- Undercarriage Inspection

Inspects suspension parts and checks for rust

Should a car not meet any of the test standards, repairs must be made before carrying out the inspection.

English-speaking and nearby garages

List of English speaking and nearby car garages

Frequently Asked Car Questions

Please click here to learn more.