Pension Related

Claiming Your Lump-Sum Pension

Paying into a pension scheme is a requirement for everyone living and working in Japan over 20. However, if you are planning on leaving Japan permanently, you have two options regarding your pension.

Totalization

With this option, citizens from certain countries can add the time they've contributed to the Japanese pension scheme to that of their own country. The agreements between Japan and each country differ from place to place. Therefore, if you are interested in this option, it is best to speak with your consulate.

Lump-Sum Withdrawal Payments:

If you wish to apply for the lump-sum withdrawal payments, you can recover up to 3 years of pension payments in one lump sum after leaving Japan. If you use this option, you will forfeit your right to claim pension coverage in the future. If you are interested in receiving a lump sum payment, the processes are detailed below.

Please note that you will only receive about 80% of the whole amount of lump-sum payment since it is subject to a taxation method called withholding income tax (about 20%).

Qualifying for Lump-Sum Withdrawal Payments

- Applying within two years of leaving Japan

- Not possessing Japanese citizenship

- Having paid premiums for six months or more

- Not having a place of residence in Japan (canceled Alien Registration/ Residence Card)

- Never been qualified for pension benefits including Disability Allowance

Necessary Documents

- Photocopy of your passport

- Documents issued by your bank about your bank account or a copy of your passbook, or void check, etc.

4. include documents that show IBAN or SWIFT/BIC code (all areas) of the bank

- A copy of the document showing your Basic Pension Number in Japan (基礎年金番号)

- A copy of a deleted residence record (revision history of a residence record:除票) or a document that shows your Resident Register Code

Please go to the Village/City Office in your area and ask for the document with 住民票コード(Resident Register Code) BEFORE LEAVING JAPAN.

- Application form for the lump-sum withdrawal payment

Can be obtained from the Private School Mutual Aid website.

Before Leaving Japan

- Visit Private School Mutual Aid website and download the application form.

- Submit a moveout notification (転出届 tenshutsu-todoke) to your municipal office within two weeks prior to the day you plan to move out.

- Right after submitting a moveout notification, ask for a residence certificate (住民票 juuminhyoo) with Resident Register Code (住民票コード juuminhyo koodo)

After Leaving Japan

- Fill out the form(s) and mail them to PSMA (and the Japanese Social Insurance Agency for employees if you were working in Japan before 2011). Include all the necessary documents.

- Wait for the payment to be deposited in your overseas account.

- “Notification of Lump-Sum Withdrawal Payment Confirmation” (脱退一時金支給決定通知書 - dattaiichijikin shikyu ketteitsuuchisho) will arrive at your address in your home country as a receipt for the payment. Keep this form for your record.

OPTIONAL: Claiming the tax refund

BEFORE Leaving Japan

-

Please note that OIST will NOT act as your tax representative.

-

The representative must be a Japanese national or a non-Japanese with a valid residence card with high-level of Japanese language skill.

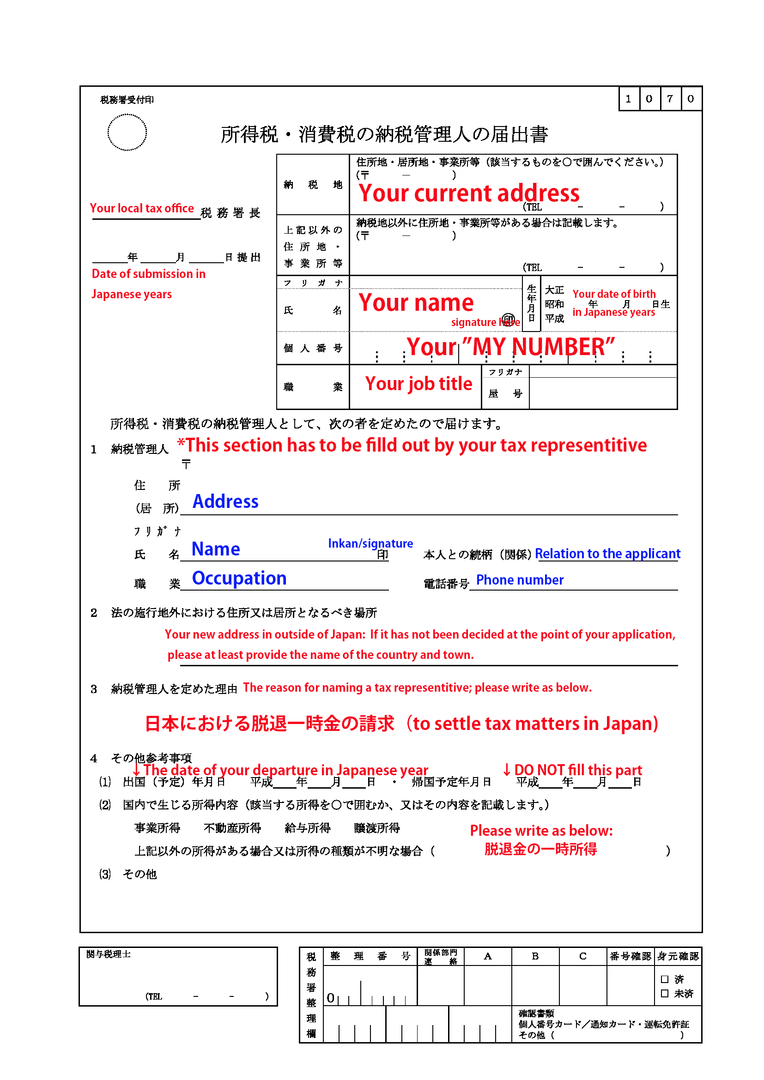

2) Go to your local tax office and get the Nozei Kanrinin no Todokesho納税管理人の届け書 (Tax Representative Declaration Form) or download a copy here.

3) Fill out 2 copies of the form with your Tax Representative and submit to your local tax office: one to turn in, the other for your Tax Representative to keep.

AFTER Leaving Japan