Pension

Pension

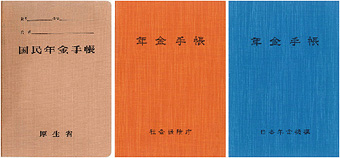

Everyone in Japan from 20 to 60 years of age regardless your nationality, must pay into the National Pension Scheme. If you are an OIST direct employee, you will automatically be enrolled into PSMA which is Employee's Pension Scheme.

Please refer to the site: Japan Pension Service.

http://www.nenkin.go.jp/n/www/english/index.jsp