1-5. Documents for New Hire

You can find information on required documents and onboarding-related procedures.

Please go through the information before your employment start date.

Dependents have a different enrolment procedure if you wish to enrol your family as your dependent.

Please complete the web form within three days of receiving the instruction message.

NOTE: "Dependent (s) "is a spouse and children who share the same livelihood with you.

You can request to enrol your dependent (s) if they meet the social insurance and tax requirements.

Please click HERE to learn more about the required dependent (s) documents.

New Hire Documents must be submitted by your appointment date or Registration date for the HEART System. (Heart system is the enterprise core system for Human resources and Financing at OIST. )

If you cannot prepare the required documents by the due date, please inform the HR staff in advance.

<GigaCC upload URL- New hire documents>

■ Download check List *In Japanse. The English version will be released soon

| ◎ | Every employee |

| ▲ | Only applicable employees |

Please refer to the Documents for New Hire for the details.

Due date: Before/on the start date and HEART Registration date

- Residence Certificate

- Salary Deposit Account

- Individual Number (My Number)

- Three Emergency Contacts

- Application for (Change in) Exemption for Dependents of Employment Income Earner

- Japanese Pension Book or equivalent

- Employment Insurance Identification Number or equivalent

- Housing Contract (all pages including the front cover)

- Tax withholding slip from Previous Employer

- Notice of Special Residential Tax Collection or Residential Tax Payment slip

- Residence Card Copy

- Private School Mutual Aid (PSMA) Number

International Relocation_Have never lived in Japan. Click on items for more information.

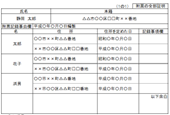

| Category | Documents | |

| ◎ | Residence Certificate | |

| ◎ | Salary Deposit Account | |

| ◎ | Individual Number (My Number) | |

| ◎ | Three Emergency Contacts | |

| ◎ | Application for (Change in) Exemption for Dependents of Employment Income Earner | |

| ▲ | Housing Contract (all pages including front cover) | For those who are subjected |

| ▲ | Residence Card Copy | For non-Japanese only |

International Relocation_have lived in Japan. Click on items for more information.

| Category | Documents | |

| ◎ | Residence Certificate | |

| ◎ | Salary Deposit Account | |

| ◎ | Individual Number (My Number) | |

| ◎ | Three Emergency Contacts | |

| ◎ | Application for (Change in) Exemption for Dependents of Employment Income Earner | |

| ◎ | Japanese Pension Book or equivalent | |

| ▲ | Employment Insurance Identification Number or equivalent | Worked in Japan before |

| ▲ | Housing Contract (all pages including front cover) | Those who are subjected |

| ▲ | Residence Card Copy | For non-Japanese only |

| ▲ | Private School Mutual Aid (PSMA) Number | Those who had enrolled with PSMA in the past |

Domestic Relocation (within Japan) Click on items for more information

| Category | Documents | |

| ◎ | Residence Certificate | |

| ◎ | Salary Deposit Account | |

| ◎ | Individual Number (My Number) | |

| ◎ | Three Emergency Contacts | |

| ◎ | Application for (Change in) Exemption for Dependents of Employment Income Earner | |

| ◎ | Japanese Pension Book or equivalent | |

| ▲ | Employment Insurance Identification Number or equivalent | Worked in Japan before |

| ▲ | Housing Contract (all pages including front cover) | Those who are subjected |

| ▲ | Tax withholding slip from Previous Employer | Worked in Japan before |

| ▲ | Notice of Special Residential Tax Collection or Residential Tax Payment slip | Subjected persons only |

| ▲ | Residence Card Copy | For non-Japanese |

| ▲ | Private School Mutual Aid (PSMA) Number | Those who had enrolled with PSMA in the past |

Relocation-related document(s) before hiring

- If you have an address in Japan: Notification for Move-out / Move-in

- If you do not have an address registered in Japan: KOSEKI TOHON / KOSEKI no FUHYO (Japanese only)

Click on the button for details.

Purpose of Usage of the Specific Personal Information

HR Management Section will use your and your dependents' individual numbers (stipulated by the act on the use of numbers to identify a specific individual in the administrative procedure) for the purposes limited in the table below.

| Tax | 1 | Withholding tax statement issuance |

| 2 | Declaration of dependents' exemption for income tax, and declaration of deduction for insurance premiums and special tax exemption for spouse | |

| 3 | Declaration on the beneficiaries of retirement income | |

| 4 | Property formation savings applications and declarations | |

| Social Insurances | 1 | Private school mutual aid notifications |

| 2 | Private school mutual aid applications and claims | |

| 3 | Employment insurance notifications | |

| 4 | Employment insurance applications and claims | |

| 5 | Employment insurance certificate issuance |

Click on the button for details

PSMA/Social Insurance

The Private School Mutual Aid Scheme provides three types of services: short-term benefits (health insurance), pension and other benefits (pensions) and welfare services to maintain and improve the health of members and their dependants and to support them in their daily lives.

Health insurance = short-term benefit programmes provide benefits to enrollees and dependants for illness, injury, maternity, death, absence from work and disasters.

Employees' pensions and company pensions = Pension and other benefits programmes provide pensions and lump-sum payments to members and their survivors when they reachatoe, become disabled or die in order to stabilise their lives.

| Full-time employees must join. |

membership requirement for part-time employees (1) More than 20 hours of scheduled work per week (2) Monthly Wages of more than 88,000 per month (3) Expected to be employed for more than two months (4) Not a student (5) The school corporation, the employer, is a 'specified school corporation with a size of more than 100 employees in total. |

Click on the button for details.

Employment insurance provides unemployment and other benefits to those unemployed or receiving educational training to stabilise workers' lives and employment and promote employment.

It also provides two services to prevent unemployment, correct employment conditions and increase employment opportunities, develop and improve workers' abilities and otherwise promote workers' welfare.

| Full-time employees must join. |

membership requirement for part-time employees (1)Expected to be employed for at least 31 days (2)More than 20 hours of scheduled work per week |

|

New Hire documents |

|

|

This information is required for your address confirmation, housing allowance(If applicable), and social insurance. |

|

|

This information is required for payroll transfers. |

|

|

This information is required for tax and social insurance procedures. |

|

|

This is required as a contact person in case of disaster or emergency unavoidable circumstances. |

|

|

Application for (Change in) Exemption for Dependents of Employment Income Earner This information is required for payroll transfers. |

|

|

Japanese Pension Book or equivalent This information is required for social insurance procedures. |

|

There is a different enrolment procedure if you wish to enrol your family as your dependent(s). Please go through the information below.

Health Insurance coverage: under 75 years old/健康保険の対象:75歳未満

Pension System coverage: 20 - 60 years old/年金の対象:20歳~60歳未満

*If you wish to enrol your spouse as a dependent, they must also enrol in a pension scheme (subject to age-based conditions).

Income limits for dependants

|

Breakdown of Income |

Under age 60 |

Age 60 or older |

|

Salary income only |

Under 1,300,000 yen/year |

Under 1,800,000 yen/year |

|

Earnings in addition to salary |

Under 1,300,000 yen/year |

Under 1,800,000 yen/year |

|

Disability Pension benefits |

Under 1,800,000 yen/year |

Under 1,800,000 yen/year |

|

Old-age/Survivors' Pension Benefits |

Under 1,300,000 yen/year |

Under 1,800,000 yen/year |

|

Unemployment and sickness benefits, etc. |

The daily amount received: less than 3,612 yen |

|

Residents in Japan: from Okinawa or moved from other parts of Japan

Moved from outside of Japan: International relocation

- Spouse without income (Japanese)

- Spouse without income (non-Japanese)

- Spouse with income (Japanese)

- Spouse with income (non-Japanse)

- Child(ren) without income (Japanese)

- Child(ren) without income (non-Japanese)

- Child(ren) with income (Japanese)

- Child(ren) with income (non-Japanese)

*If you only wish to enrol the child(ren) as your dependent(s), the following documents must be submitted.

|

If you have a spouse |

one of the following |

・Copy of the Tax Withholding statement (of the spouse) |

|

・Original Certificate of Annual Income Prospects (of the spouse) |

||

|

If you do not have a spouse |

one of each |

Original copy of your family register and the child's family register |

- Japanese Pension Book or equivalent

- Tax Exemption Certificate for Dependent(s)

- Confirmation documents for Individual Number (My Number)

- Residence Certificate with a whole record or KOSEKI TOHON

- Relationship Notice form for Category three insured persons of Japanese National Pension

- Affidavit of Dependent (Dictation stating that they have no income in Japan or abroad)

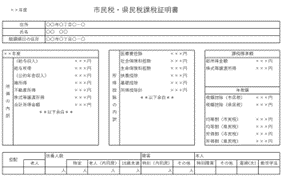

Example

Example - Spouse's tax withholding statement

- Certificate of Annual Income Prospects and social Ins. Non-enrollment

- PMSA: Notification form for dependent

A Spouse with no income (domestic - Japanese or foreign national)

Documents to be prepared before/on the start date or the day of HEART registration

|

Tick box |

Relationship |

Documents |

|

|

Spouse

|

Japanese Pension Book or equivalent |

|

|

Certificate of Annual Income / Certificate of completed tax return |

|

|

|

Confirmation documents for Individual Number (My Number) |

|

|

|

Tax Exemption Certificate for Dependent(s) |

|

|

|

Residence Certificate with a whole record or KOSEKI TOHON |

|

|

|

Relationship Notice form for Category three insured persons of Japanese National Pension |

B Spouse with income (domestic - Japanese or foreign nationals)

Documents to be prepared before/on the start date or the day of HEART registration

|

Tick box |

Relationship |

Documents |

|

|

Spouse

|

Japanese Pension Book or equivalent |

|

|

Certificate of Annual Income / Certificate of completed tax return |

|

|

|

Confirmation documents for Individual Number(My Number) |

|

|

|

Tax Exemption Certificate for Dependent(s) |

|

|

|

Residence Certificate with a whole record or KOSEKI TOHON |

|

|

|

Relationship Notice form for Category three insured persons of Japanese National Pension |

C Spouse without income (Overseas - Japanese)

Documents to be prepared before/on the start date or the day of HEART registration

|

Tick box |

Relationship |

Documents |

|

|

Spouse |

Japanese Pension Book or equivalent |

|

|

Confirmation documents for Individual Number(My Number) |

|

|

|

Copy of Passport, Photo page, and landing stamp (the last departure stamp from Japan if only there is one) |

|

|

|

Residence Certificate with a whole record or KOSEKI TOHON |

|

|

|

Affidavit of Dependent (Dictation stating that they have no income in Japan or abroad) |

|

|

|

Relationship Notice form for Category three insured persons of Japanese National Pension |

D Spouse without income (Overseas - foreign nationals)

Documents to be prepared before/on the start date or the day of HEART registration

|

Tick box |

Relationship |

Documents |

|

|

Spouse |

Confirmation documents for Individual Number(My Number) |

|

|

Copy of Passport, Photo page, and landing stamp (the last departure stamp from Japan if only there is one) |

|

|

|

Residence Certificate with a whole record or KOSEKI TOHON |

|

|

|

Affidavit of Dependent (Dictation stating that they have no income in Japan or abroad) |

|

|

|

Relationship Notice form for Category three insured persons of Japanese National Pension |

E Spouse with income (Overseas - Japanese)

Documents to be prepared before/on the start date or the day of HEART registration

|

Tick box |

Relationship |

Documents |

|

|

Spouse |

Japanese Pension Book or equivalent |

|

|

Confirmation documents for Individual Number(My Number) |

|

|

|

Copy of Passport, Photo page, and landing stamp (the last departure stamp from Japan if only there is one) |

|

|

|

Residence Certificate with a whole record or KOSEKI TOHON |

|

|

|

Certificate of Annual Income / Certificate of completed tax return |

|

|

|

Relationship Notice form for Category three insured persons of Japanese National Pension |

F Spouse with income (Overseas - foreign national)

Documents to be prepared before/on the start date or the day of HEART registration

|

Tick box |

Relationship |

Documents |

|

|

Spouse |

Confirmation documents for Individual Number(My Number) |

|

|

Copy of Passport, Photo page, and landing stamp (the last departure stamp from Japan if only there is one) |

|

|

|

Residence Certificate with a whole record or KOSEKI TOHON |

|

|

|

Certificate of Annual Income / Certificate of completed tax return |

|

|

|

Relationship Notice form for Category three insured persons of Japanese National Pension |

Child(ren) with no income (domestic - Japanese or foreign national)

Documents to be prepared before/on the start date or the day of HEART registration

Under High School

|

Tick box |

Relationship |

Documents |

|

|

Child(ren) |

Confirmation documents for Individual Number(My Number) |

High School and University students

|

Tick box |

Relationship |

Documents |

|

|

Child(ren) |

Confirmation documents for Individual Number(My Number) |

|

|

|

Copy of student ID card |

Postgraduate students and the students in the evening and correspondence courses

|

Tick box |

Relationship |

Documents |

|

|

Child(ren) |

Confirmation documents for Individual Number(My Number) |

|

|

Copy of student ID card |

|

|

|

Tax Exemption Certificate |

Child(ren) with income (domestic - Japanese or foreign national)

Documents to be prepared before/on the start date or the day of HEART registration

High School, University, Postgraduate students and the students in the evening and correspondence courses

|

Tick box |

Relationship |

Documents |

|

|

Child(ren) |

Confirmation documents for Individual Number(My Number) |

|

|

Copy of student ID card |

|

|

|

Certificate of Annual Income / Certificate of completed tax return |

|

|

|

Copy of Passport, Photo page, and landing stamp (the last departure stamp from Japan if only there is one) |

Child(ren) with income (Overseas - Japanese or foreign national)

Documents to be prepared before/on the start date or the day of HEART registration

High School, University, Postgraduate students and the students in the evening and correspondence courses

|

Tick box |

Relationship |

Documents |

|

|

Child(ren) |

Confirmation documents for Individual Number(My Number) |

|

|

|

Copy of student ID card |

|

|

|

Certificate of Annual Income / Certificate of completed tax return |

Child(ren) with no income (Overseas - Japanese or foreign national)

Documents to be prepared before/on the start date or the day of HEART registration

Under high school

|

Tick box |

Relationship |

Documents |

|

|

Child(ren) |

Confirmation documents for Individual Number(My Number) |

|

|

|

Copy of Passport, Photo page, and landing stamp (the last departure stamp from Japan if only there is one) |

High School and University Students

|

Tick box |

Relationship |

Documents |

|

|

Child(ren) |

Confirmation documents for Individual Number(My Number) |

|

|

Copy of student ID card |

|

|

|

Copy of Passport, Photo page, and landing stamp (the last departure stamp from Japan if only there is one) |

Postgraduate and Students in the evening and correspondence courses

|

Tick box |

Relationship |

Documents |

|

|

Child(ren) |

Confirmation documents for Individual Number(My Number) |

|

|

Copy of student ID card |

|

|

|

Affidavit of Dependent (Dictation stating that they have no income in Japan or abroad) |

|

|

|

Copy of Passport, Photo page, and landing stamp (the last departure stamp from Japan if only there is one) |

|

Required Documents for Dependent(s) |

|

|

Japanese Pension Book or equivalent Those who live/have lived in Japan |

|

|

Tax Exemption Certificate for Dependent(s) -Original Copy To prove that the dependent(s) has no income and if they are a resident of Japan, an up-to-date (original) tax exemption certificate must be submitted. |

|

|

Ex. Individual Number Card (My Number Card), Individual Number Notification Card and other documents such as residence certificate. |

|

|

Residence Certificate with a whole record-Original Copy Please submit a certificate of residence with all the details listed and not omitted. |

|

|

Relationship Notice form for Category three insured persons of Japanese National Pension -Original Copy If you wish to enrol your spouse as a dependent, they must also register in a pension scheme. |

|

|

Certificate of Annual Income Prospects and social Ins. Non-enrollment -Original Copy Proof of annual income for the year ahead, starting with the employee's hiring date officially issued and sealed by the spouse's employer. |

|

|

Spouse's tax withholding statement if you only have the child(ren) as a dependent(s) -Original Copy An annual withholding tax certificate is required. |

|